Fuse Treasury Transparency Report

As we prepare for the upcoming launch of Fuse Ember and the broader expansion of our Layer 2 ecosystem, it’s important to provide the community with a clear view of Fuse’s treasury structure and long-term financial strategy.

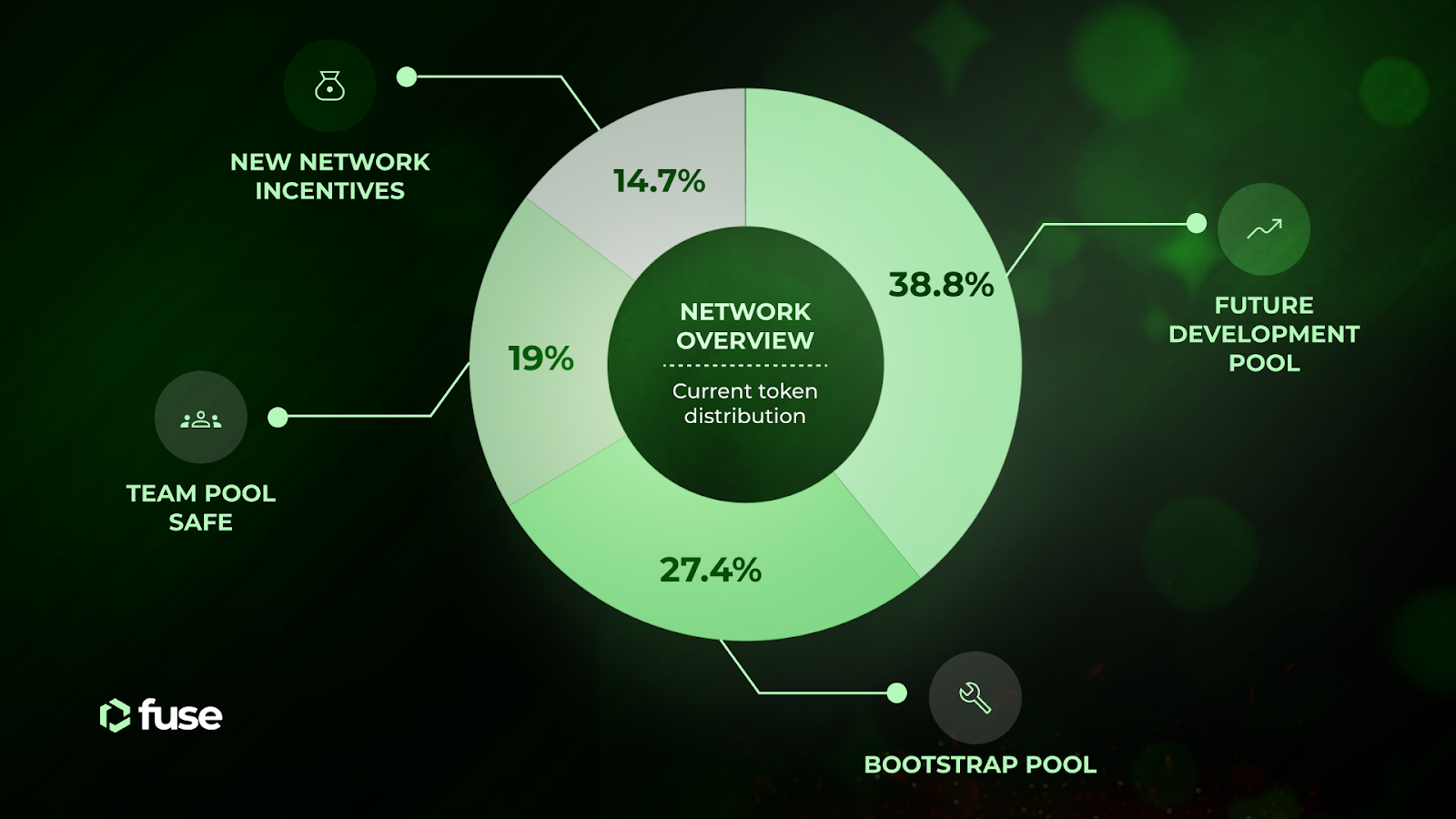

As of April 25, 2025, Fuse Network’s treasury holds approximately 136,812,240 $FUSE. These funds are strategically allocated across multiple dedicated pools, each designed to support specific areas of network growth, from core development and liquidity programs to grants, partnerships, and community-driven initiatives.

In this report, we break down the current treasury holdings, allocation purposes, and the guiding principles behind our treasury management approach, reinforcing our long-standing commitment to building a sustainable, decentralized financial ecosystem.

Treasury Breakdown

Fuse’s treasury is diversified into various pools as follows:

1. Team Pool Safe - 0xee80276cd5691ddce00ec164e9395684363a5b91

- Allocation: 24,695,833 $FUSE, locked until 2028 with a 1 year cliff.

- Purpose: Set aside for future projects to support the network's long-term success. Locked funds ensure smart budgeting and are ready for important goals or unexpected needs

2. Future Development Pool - 0x48982611e6d7413ea88f4c911fbd3dc029004e5e

- Allocation: 50,355,136 $FUSE. locked until 2028 with a 1 year cliff.

- Purpose: Dedicated to funding innovation, ecosystem enhancements, and technical advancements.A robust development fund ensures the network remains competitive and adaptive, fostering continuous growth.

3. Bootstrap Pool - 0xc7e1cad138d6d4478b60e27ccd501af3e2c2ede3 - lock

- Allocation: 35,595,099 $FUSE (), locked until 2026 with 1 year cliff.

- Purpose: To attract and foster strategic partnerships that strengthen Fuse's ecosystem, provide liquidity support, and offer incentives.

- Why It Matters: Building and nurturing strategic partnerships can drive network adoption, strengthen the ecosystem, provide liquidity support, offer incentives, and create new revenue streams for long-term sustainability.

4. New Network Incentives (multiple wallets)

- Allocation: 19,095,049 $FUSE + 7,071,123 $FUSE (from NodeSale) = 26,166,172 $FUSE

- Purpose: To drive adoption of the new network by providing incentives for testnet participation, builder grants, liquidity support, and other initiatives.

- Why It Matters: Encouraging feedback from the testnet, attracting projects to build on the network, securing liquidity, and boosting total value locked (TVL).

We have adopted a multi-pool approach for diversification to achieve an optimal balance between immediate operational needs, future growth investments, and strategic incentives. This approach minimizes risk, provides liquidity for ongoing development, and safeguards the network against potential market volatility during a bear cycle. From the beginning, we have aligned our diversification strategies with best practices in treasury management to emphasize resilience and sustainability.

Network Overview: Current Token Distribution

| Pool Name | Address/Wallet | Allocation | Purpose |

|---|---|---|---|

| Team Pool Safe | 0xee80276cd5691ddce00ec164e9395684363a5b91 | 24,695,833 $FUSE | Long-term team & project growth |

| Future Development Pool | 0x48982611e6d7413ea88f4c911fbd3dc029004e5e | 50,355,136 $FUSE | Development, upgrades & innovation |

| Bootstrap Pool | 0xc7e1cad138d6d4478b60e27ccd501af3e2c2ede3 | 35,595,099 $FUSE | Partnerships, liquidity & community incentives |

| New Network Incentives Pool | Multiple wallets | 26,166,172 $FUSE | Ember L2 incentives, grants, liquidity growth |