FUSE Token

The network’s native token is the Fuse Token (FUSE). This is used in several ways within the ecosystem, including:

Transaction fees: As FUSE is the native currency of the Fuse Network blockchain, users must pay transaction fees (gas) in FUSE.

Payments: As the native currency, sending FUSE does not require interactions with smart contracts. FUSE transfers therefore generally require lower transaction fees than ERC-20 transfers.

Validation: Token holders can stake FUSE to become a validator. The minimal staking requirement is 100,000 FUSE. While the network is continuously growing, there are currently 60+ validators.

Voting: Validators can vote on protocol changes with their staked FUSE and with the tokens delegated to them by stakers. This means validators with a larger amount of FUSE staked or delegated have greater voting rights on network upgrades and governance changes.

Staking: FUSE holders can choose one or more validators to delegate and stake their tokens. They receive a share of the Fuse block rewards proportionate to the share of their stake in the total stake, minus the minimum 15% fee paid to the validator(s).

➡️ Get FUSE on Voltage Finance

➡️ The Ultimate Guide to Getting Fuse Tokens

FUSE Tokenomics

Fuse is preparing an updated tokenomics framework to align with the network’s transition to a modern zk rollup architecture through a full-state migration.

This upgrade is in-place, meaning all balances, contracts, and token supply remain intact. The FUSE token continues as the native asset of the network. No new token will be issued, and no bridging or manual migration is required.

TLDR

Fuse’s tokenomics are evolving to align with its full-state migration and zk rollup architecture:

- No new token: same supply, same balances.

- Transition to a revenue-based, deflationary economy.

- Fee burning (FIP-1559) and a 400M max supply.

- Rewards and yields are tied to real network performance.

- stFUSE introduces liquid staking and revenue sharing for long-term sustainability.

Why Tokenomics Are Evolving

The existing token model was designed for an earlier phase of the network, focused on inflationary rewards to bootstrap validator and community participation.

With the upgrade to Fuse Ember, the network is adopting a revenue-based, deflationary model — one that rewards real network usage and protocol activity rather than continuous token emissions.

This transition aligns with Fuse’s broader economic goals:

- Building a sustainable, long-term economy supported by real revenue flows.

- Reducing inflation and setting a capped total supply.

- Strengthening the link between network performance and token utility.

FUSE Token Utility

The FUSE token remains the core utility and governance asset of the network. It underpins all economic and governance mechanisms, including:

Gas fees: Used for transaction payments and network operations.

- Staking and Governance: Locked in stFUSE to secure the network and participate in decision-making.

- Protocol Revenue Sharing: stFUSE holders earn a share of network fees, sequencer revenue, and service-based income.

- Ecosystem Participation: Used across DeFi protocols and consumer apps built on Fuse (Solid, Voltage, Freedom, etc.).

As Fuse transitions into a rollup-based L2 architecture, these use cases remain continuous while transaction efficiency and scalability improve.

Inflation Reduction and Max Supply

To ensure long-term sustainability, Fuse is gradually transitioning toward a deflationary token model and introducing a maximum supply cap of 400,000,000 FUSE, approved through community governance.

This transition was originally proposed in the Inflation Reduction and Max Supply initiative, following governance discussions around FRC002 and the implementation of FIP-1559 (fee burning).

Key points of this framework:

- Gradual Inflation Reduction: The network’s inflation rate is being decreased in stages, ensuring stability for validators and stakers while progressively reducing token emissions.

- Fee Burning (FIP-1559): A portion of every transaction’s base fee is burned, permanently removing tokens from circulation and offsetting emissions. This mechanism strengthens scarcity and moves Fuse toward a net-deflationary state as usage grows.

- Max Supply Cap: The total supply of FUSE will never exceed 400 million tokens, ensuring long-term predictability and value preservation.

- Projected Outcome: Fuse is expected to reach a near-zero or deflationary state (inflation <1%) around 2027, depending on overall network activity and fee burn rates.

This model ensures that token value scales with network usage. The more the network is used, the more sustainable and scarce FUSE becomes.

Key Principles of the New Tokenomics Model

While full details will be released in a dedicated proposal, the updated tokenomics will center on:

- Full-State Continuity: No change to supply or circulating balances during migration.

- Revenue-Based Rewards: Staking rewards sourced from network revenue such as sequencer fees, service income, and other protocol-level fees.

- stFUSE Integration: A liquid staking and revenue-sharing mechanism for sustainable, yield-based participation.

- Foundation Incentives: Temporary transition incentives from the Fuse Foundation to maintain staking yields while fee-based rewards ramp up.

- Deflationary Stability: A fixed max supply, fee burning, and reduced emissions model supporting long-term value.

Key Principles of the New Staking Rewards Model

The new reward model is designed to be sustainable and activity-driven:

- Sequencer Fees: Share of transaction inclusion fees paid by network users.

- Protocol Service Revenue: Income from FuseBox, Charge, and other middleware services.

- Ecosystem Flows: Fees and yield from consumer apps such as Solid and Freedom.

- Foundation Incentives: Initial rewards are distributed until on-chain revenue sources are self-sustaining.

What’s Changing in FUSE Tokenomics

- Reward model: from inflationary emissions → revenue-based rewards.

- Token structure: from growth-based inflation → capped, deflationary economy.

- Staking mechanism: introduction of stFUSE for liquid staking and DeFi integration.

- Economic alignment: rewards directly linked to network performance and usage.

What’s Staying the Same in FUSE Tokenomics

- Token supply continuity: no new token issuance.

- FUSE utility: still used for fees, staking, and governance.

- User balances: all accounts, contracts, and balances remain intact.

Next Steps

A comprehensive Fuse Ember Tokenomics Proposal is being developed and will include:

- Detailed supply and allocation overview.

- Revenue and reward distribution mechanics.

- Governance integration via stFUSE.

- Inflation reduction roadmap and supply cap enforcement.

Once finalized, the proposal will be published for community review and governance approval.

Treasury

Fuse Treasury Transparency Report

As we prepare for the upcoming launch of Fuse Ember and the broader expansion of our Layer 2 ecosystem, it’s important to provide the community with a clear view of Fuse’s treasury structure and long-term financial strategy.

As of April 25, 2025, Fuse Network’s treasury holds approximately 136,812,240 $FUSE. These funds are strategically allocated across multiple dedicated pools, each designed to support specific areas of network growth, from core development and liquidity programs to grants, partnerships, and community-driven initiatives.

In this report, we break down the current treasury holdings, allocation purposes, and the guiding principles behind our treasury management approach, reinforcing our long-standing commitment to building a sustainable, decentralized financial ecosystem.

Treasury Breakdown

Fuse’s treasury is diversified into various pools as follows:

1. Team Pool Safe - 0xee80276cd5691ddce00ec164e9395684363a5b91

- Allocation: 24,695,833 $FUSE, locked until 2028 with a 1 year cliff.

- Purpose: Set aside for future projects to support the network's long-term success. Locked funds ensure smart budgeting and are ready for important goals or unexpected needs

2. Future Development Pool - 0x48982611e6d7413ea88f4c911fbd3dc029004e5e

- Allocation: 50,355,136 $FUSE. locked until 2028 with a 1 year cliff.

- Purpose: Dedicated to funding innovation, ecosystem enhancements, and technical advancements.A robust development fund ensures the network remains competitive and adaptive, fostering continuous growth.

3. Bootstrap Pool - 0xc7e1cad138d6d4478b60e27ccd501af3e2c2ede3 - lock

- Allocation: 35,595,099 $FUSE (), locked until 2026 with 1 year cliff.

- Purpose: To attract and foster strategic partnerships that strengthen Fuse's ecosystem, provide liquidity support, and offer incentives.

- Why It Matters: Building and nurturing strategic partnerships can drive network adoption, strengthen the ecosystem, provide liquidity support, offer incentives, and create new revenue streams for long-term sustainability.

4. New Network Incentives (multiple wallets)

- Allocation: 19,095,049 $FUSE + 7,071,123 $FUSE (from NodeSale) = 26,166,172 $FUSE

- Purpose: To drive adoption of the new network by providing incentives for testnet participation, builder grants, liquidity support, and other initiatives.

- Why It Matters: Encouraging feedback from the testnet, attracting projects to build on the network, securing liquidity, and boosting total value locked (TVL).

We have adopted a multi-pool approach for diversification to achieve an optimal balance between immediate operational needs, future growth investments, and strategic incentives. This approach minimizes risk, provides liquidity for ongoing development, and safeguards the network against potential market volatility during a bear cycle. From the beginning, we have aligned our diversification strategies with best practices in treasury management to emphasize resilience and sustainability.

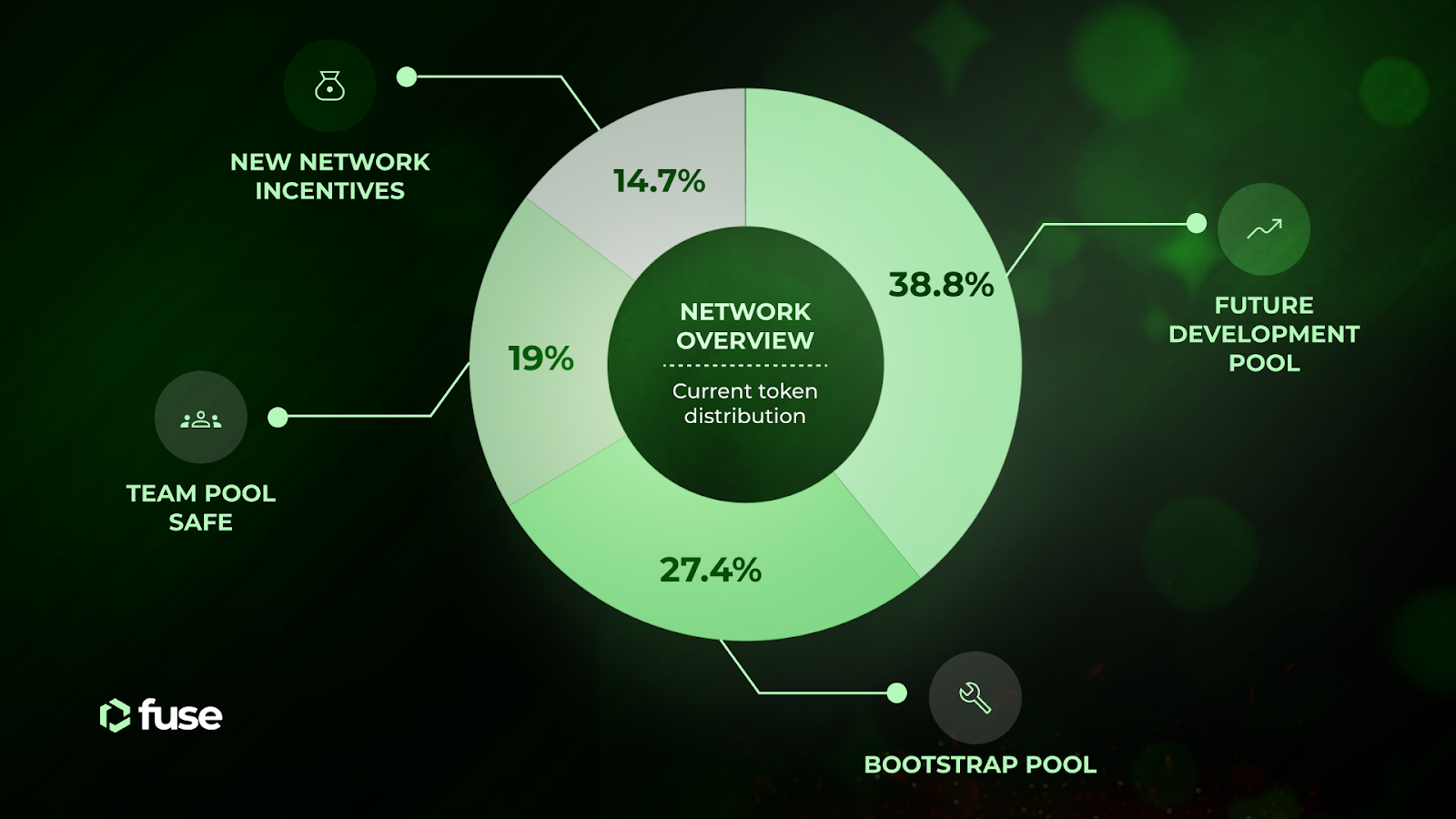

Network Overview: Current Token Distribution

| Pool Name | Address/Wallet | Allocation | Purpose |

|---|---|---|---|

| Team Pool Safe | 0xee80276cd5691ddce00ec164e9395684363a5b91 | 24,695,833 $FUSE | Long-term team & project growth |

| Future Development Pool | 0x48982611e6d7413ea88f4c911fbd3dc029004e5e | 50,355,136 $FUSE | Development, upgrades & innovation |

| Bootstrap Pool | 0xc7e1cad138d6d4478b60e27ccd501af3e2c2ede3 | 35,595,099 $FUSE | Partnerships, liquidity & community incentives |

| New Network Incentives Pool | Multiple wallets | 26,166,172 $FUSE | Ember L2 incentives, grants, liquidity growth |

Where to buy FUSE

CEXes

Centralized exchanges (CEXes) facilitate the trading, buying, and selling of various cryptocurrencies. These platforms operate as an intermediary between users by providing a centralized online marketplace where participants can exchange digital assets for other cryptocurrencies or fiat currency.

You can buy FUSE from the centralized exchanges listed below:

| CEX |

|---|

| Gate.io |

| Huobi Global |

| MEXC Global |

| AscendEX |

DEXes

A DEX (decentralized exchange) is a peer-to-peer marketplace where users can trade cryptocurrencies in a non-custodial manner, without the need for an intermediary to facilitate the transfer and custody of funds. DEXs substitute intermediaries—traditionally, banks, brokers, payment processors, or other institutions—with blockchain-based smart contracts.

You can swap FUSE using the decentralized exchanges listed below:

| DEX |

|---|

| Fluxswap |

| IcecreamSwap |

| Mirakle |

| PancakeSwap |

| Quickswap |

| Rango Exchange |

| Sushi |

| Uniswap |

| Voltage |

Fiat On-Ramps

Fiat on-ramps and off-ramps are services that facilitate the exchange of fiat currencies for cryptocurrencies and tokens such as FUSE, USDC or USDT, and vice versa. There are several types of fiat on-ramps and off-ramps, including platforms for cryptocurrency transactions, peer-to-peer (P2P) platforms, brokerage services, and payment processors. Each type caters to different user needs.

| On/Off-Ramps |

|---|

| PayBis |

| Transak |

| TransFi |

More information about FUSE trading volumes and prices on various exchanges can be found on the FUSE token CoinMarketCap page.

Yield Farming FUSE Token

The project team occasionally uses the FUSE token to power liquidity reward (yield farming) programs to boost liquidity on DEXes and participation in the Fuse Lending Network.

The ongoing liquidity rewards programs on DEXes can be found here.

FUSE On Other Blockchains

One way to ensure the growth of Fuse and its prospects is by enabling additional versions (wrappers) of FUSE on other chains. These wrapped FUSE take the form of ERC-20 tokens.

Wrapped versions of the FUSE token exist on Ethereum (mainnet), Binance Smart Chain, the Arbitrum One layer-2 optimistic rollup chain for Ethereum, and Optimism. The latter is a wrapper of a wrapper powered by the Ethereum-Arbitrum bridge, and its withdrawals from Arbitrum are subject to the optimistic rollup rules.

You can add these to your Web3 wallet using the below networks and contracts:

| Network | Fuse Contract |

|---|---|

| Ethereum | Etherscan |

| Polygon | Polygonscan |

| BNB Chain | BSCscan |

| Arbitrum One | Arbiscan |

| Optimism | Optimism |

| Base | Base |